Financial New Year's resolutions

There has never been a better time to start planning for your future than right now, especially when it comes to your finances.

Start the new year on a positive note by forming some good financial habits to help you stay on top of your finances all year long. Here are some ideas to help you get started.

Review your insurance policies

- Block out time on the calendar to review your accounts.

- Review rates, beneficiaries, insured amounts and more.

- Give a trusted family member important access information.

Put a cap on bad spending habits

- Target one habit such as online shopping when you're bored or eating out.

- Set a realistic goal and clear limits.

- Identify and avoid triggers.

Build up at least three months of emergency savings

- Calculate using essential monthly expenses only.

- Make sure it's easily accessible for emergencies.

- Save more if your job is unstable or you're supporting others.

Make a plan to pay off unwanted debt

- Ask for a lower interest rate.

- Focus first on the highest interest rate or lowest balance.

- Make a larger monthly payment by cutting spending elsewhere.

Prioritize that account you've been meaning to open

- Think: life insurance policy, IRA, kids' college savings, vacation fund.

- Determine your goal and calculate a savings plan.

- Set up a modest monthly auto-pay.

Commit to a no-spend day (or weekend) monthly

- Make a "fun and free" entertainment list.

- Use up food in your freezer or pantry.

- Make time for crafts, organization or home projects.

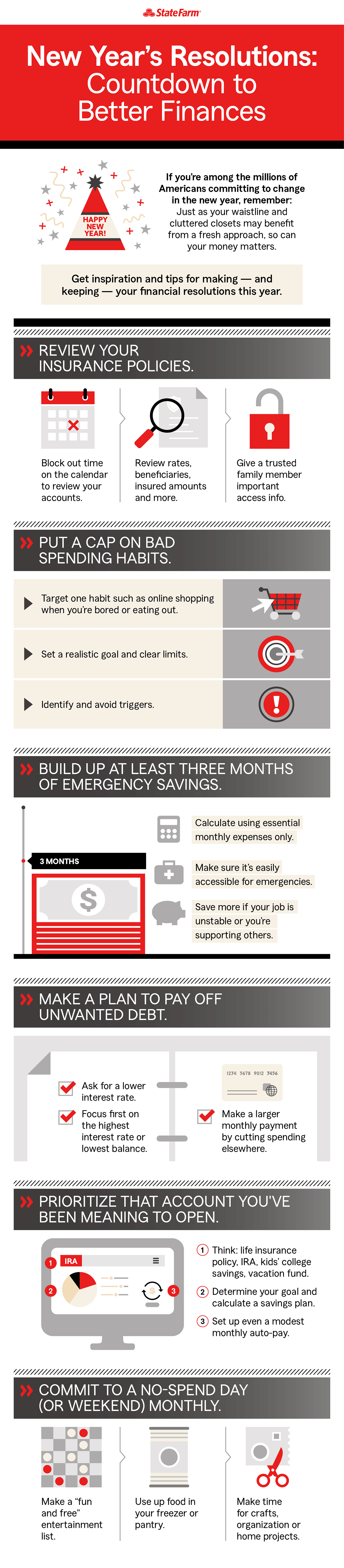

If you're among the millions of Americans committing to change in the new year, remember: Just as your waistline and cluttered closets may benefit from a fresh approach, so can your money matters.

Get inspiration and tips for making — and keeping — your financial resolutions this year.

Review your insurance policies

- Block out time on the calendar to review your accounts.

- Review rates, beneficiaries, insured amounts and more.

- Give a trusted family member important access info.

Put a cap on bad spending habits

- Target one habit such as online shopping when you're bored or eating out.

- Set a realistic goal and clear limits.

- Identify and avoid triggers.

Build up at least three months of emergency savings

- Calculate using essential monthly expenses only.

- Make sure it's easily accessible for emergencies.

- Save more if your job is unstable or you're supporting others.

Make a plan to pay off unwanted debt

- Ask for a lower interest rate.

- Focus first on the highest interest rate or lowest balance.

- Make a larger monthly payment by cutting spending elsewhere.

Prioritize that account you've been meaning to open

- Think: life insurance policy, IRA, kids' college savings, vacation fund.

- Determine your goal and calculate a savings plan.

- Set up even a modest monthly auto-pay.

Commit to a no-spend day (or weekend) monthly

- Make a "fun and free" entertainment list.

- Use up food in your freezer or pantry.

- Make time for crafts, organization or home projects.